What Is SUM (Supplementary Uninsured/Underinsured) Coverage – and Why is it So Important?

Supplemental Uninsured Motorist coverage (“UM”) is coverage that is part of an endorsement on everyone’s insurance policy in the State of New York that protects occupants of a vehicle when they are involved in a hit and run accident or hit by a vehicle with no insurance due to lapse of insurance coverage, mainly when there is a failure to pay insurance premiums. In this scenario, the injured person may make an Uninsured Motorist claim through their own automobile insurance carrier for compensation for their injuries and economic losses.

Supplemental Underinsured Motorist coverage (“SUM”) is coverage that may be available to provide additional bodily injury coverage for injured victims of motor vehicle accidents when the responsible party does not have enough insurance. In NYS, the minimum liability coverage requirement for bodily injury limits is $25,000 (per injured person) and $50,000 (per accident). More often than not, this insurance coverage is wholly inadequate to cover the pain and suffering and economic losses that an injured party suffers as a result of a motor vehicle accident. This is when SUM coverage in NY can be crucial.

What happens if the tortfeasor (the person who caused the accident) only has the minimal bodily injury (liability) coverage of $25,000 (per person) as required by NYS law AND the injured person has injuries that far exceed this coverage? In this scenario, an insurance company’s offer of the full policy limits of $25,000 may be grossly inadequate and not even come close to making an injured person whole after an accident.

Once you exhaust the tortfeasor’s automobile policy that may be available to cover an accident, this is where SUM insurance may be triggered and available from your own insurance policy to help cover losses for yourself or a member of your household (depending on who is injured). Simply said, SUM coverage can make up the difference of compensation you may be entitled to until the amount of your own automobile SUM coverage is exhausted.

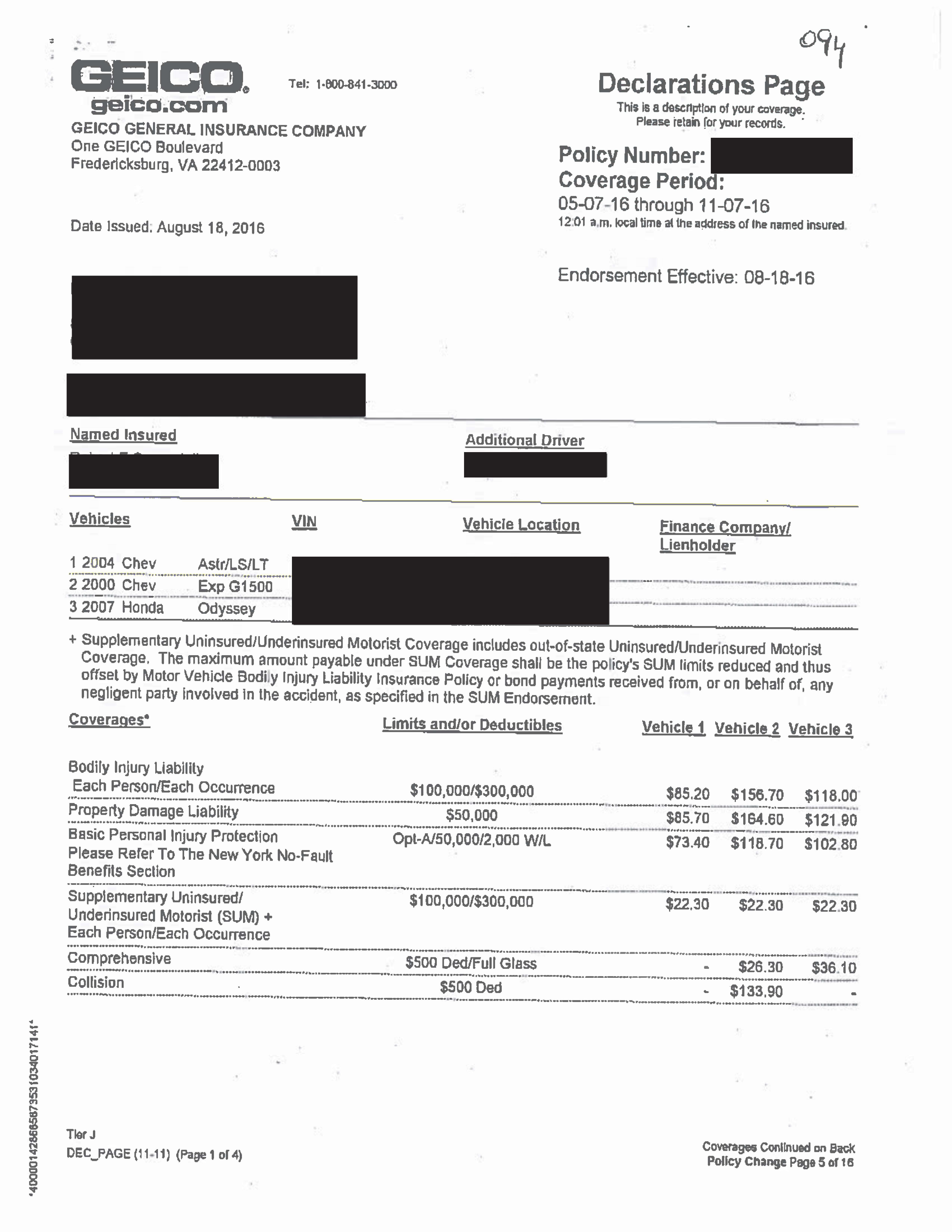

Below is an example of a Declaration (coverage) page from an injured person’s own automobile insurance policy, where the injured person purchased SUM coverage in the amount of $100,000 (per person / $300,000 (per accident):

Injured Person’s Automobile Policy:

It is important to consult with a personal injury attorney immediately following an accident since there are time requirements for SUM coverage to apply in a case. Your insurance company must be put on notice as soon as reasonably practicable after an accident of your intent to pursue SUM coverage under your policy. Also, an attorney will know how to preserve your right to pursue SUM coverage. A formal request in writing to your insurance company to obtain their consent to settle with the tortfeasor’s insurance company is required before settling your case otherwise you may forfeit your right to pursue a SUM claim thereafter.

SUM coverage is important coverage to protect yourself and members of your household when the person at fault does not have insurance coverage or has liability limits which are less than your SUM coverage limits. As such, we urge you to get a quote for raising the amount of the SUM coverage on your policy to see how much this will increase your annual premium. You may find the cost of having adequate SUM coverage is minimal compared to the risk of not having it if you are left to bear the financial burden following an automobile accident with someone who has minimal or no coverage. Also, we recommend checking into the costs of obtaining an umbrella SUM policy to protect you and your family too.

The car accident lawyers at Brindisi, Murad & Brindisi Pearlman have the experience and know how to investigate all policies of insurance that may be applicable towards your claim and find out the amounts of coverage available to help get all of the compensation you may be entitled to for your injuries. If you have been injured in a car accident, call Brindisi, Murad & Brindisi Pearlman today for a free consultation. We are ready to fight for you!

Share this blog with your friends…

Related Blogs

Who Is Liable In An Uber Car Accident?

As of 12:01 am on June 29th, 2017, ride-booking apps Uber and Lyft began working for Upstate New York residents. Finally, rideshare services enjoyed by larger cities across the country are available to Utica natives after a much-anticipated wait. What Is Uber...

Tips For Parents To Prevent Teen Texting And Driving Accidents

Every day, 11 teens die because of texting and driving. 6 out of 10 car crashes with teens involve distracted driving. 12% of these are because of a cell phone. In New York State, injuries caused by an adolescent driver resulted in about $22 million in hospital...

Graduation Party Time: 5 Ways To Prevent A Teen DUI

According to the Centers for Disease Control and Prevention, excessive consumption of alcohol is responsible for over 4,300 deaths of underage minors each year. Although it is against the law, adolescents ages 12 to 20 drink 11 percent of all alcohol consumed in the...

Injured In An Accident?

Contact BMBP Today!

BRINDISI, MURAD & BRINDISI PEARLMAN

UTICA OFFICE

Utica, NY 13501

OFFICE HOURS

MONDAY - FRIDAY

9AM-5PM